How to Choose Payroll Software

Learn how to choose the right payroll software for your business. Includes our step-by-step guide, features, tips, checklist, and FAQs.

Updated on January 6th, 2024

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

There are different factors to consider when choosing the right payroll software for your business, such as features, ease of use, integrations, support, and more. In this step-by-step guide, we evaluate these factors to help you choose payroll software that is on time, accurate, and has the necessary withholdings and deductions for each of your employees.

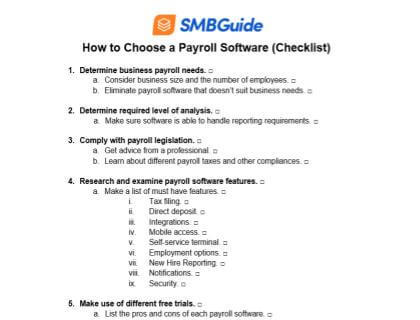

How to Choose Payroll Software Checklist - Free PDF

Stay on task and cover your bases with our detailed checklist.

How to Choose Payroll Software:

1. Define your business payroll needs.

Before you start researching the different payroll software available, establish a clear idea of what your business will need in terms of features, costs, size, ease of use, and durability.

Consider the following questions:

- How many employees do you have?

- How many seasonal or temporary employees do you have?

- How large is your business?

- What is your payroll budget?

- Will employees have benefits?

- How often will you conduct payroll?

- Who will administer payroll and how much experience do they have?

- Will you be printing out payslips for employees?

- Do you need standalone payroll software?

Use your answers to evaluate the different payroll software available. This process will help you eliminate software that doesn't suit your business needs.

2. Determine your required level of analysis.

You will need to choose payroll software that can handle your business analysis requirements. Will you need to assign payroll costs to separate cost centers in the business? Do you need to analyze your payroll costs in various departments?

Make sure you choose software that can manage your business's reporting demands by generating accurate reports, such as payroll summary, deductions and contributions, tax liability, wage and tax summary, and W-2 summary reports.

3. Comply with payroll legislation.

Consider any standard and additional payroll legislation that your company may need to follow. These will include federal, state, and local regulations. This will ensure that your payroll package is legally compliant, which will help you avoid costly penalties or financial losses.

To educate yourself on the different payroll regulations and processes that may affect your business, contact the American Payroll Association. The Association helps both employees and employers better understand U.S. payroll laws and regulations through informative courses and programs. Additionally, read through the major laws of the Department of Labour.

4. Research and examine payroll software features.

Whether they're must-haves or beneficial add-ons, evaluate the various features payroll software has to offer. These include tax filings, integrations, self-service terminals, and more. This step helps determine the best-suited software for your business, as your list of features will affect the ease of use and the accuracy of your payroll.

Niche and Standard Payroll Features:

Niche | Standard |

|---|---|

FICA tip credit for restaurants | Automated taxes |

Federal R&D tax credit | All tax forms |

Banking information management | Compliance management |

Activity dashboard | Employee self-service portal |

Calendar sync | Check printing |

Chat support | Phone support |

Lifetime accounts | Mobile access |

Digital signatures | Paperless employee onboarding |

Charitable donations | Deductions |

Expense integrations | Digital pay stubs |

Payroll Software Features to Consider:

Tax filing.

Accurately documenting and managing payroll taxes can be a complex process, no matter the size and nature of your business. Look for payroll software that will help simplify this process by automatically generating and filing state and federal taxes. This will help payroll administrators navigate the complexities of managing deductions and filing taxes.

Direct deposit.

A direct deposit feature is a great tool to have when you want to streamline processes. Paper checks can be a time-consuming task, as administrators would need to physically complete and distribute checks. By removing this task, you will save time, resources, and effort.

Integrations.

The number of integrations on offer will ultimately help streamline processes, improve analytics, and reduce time, cost, and resources. For business owners, payroll software that integrates with human resource (HR) software and accounting software can greatly reduce the risks of managing information from different departments.

Tip: Consider payroll software that integrates with time cards. This way, you won't need to enter employee hours manually.

Employee self-service portal.

A self-service portal provides your employees with easy access to their personal payroll data. With just a few simple clicks, employees can view and manage their personal data. Generally, an employee self-service terminal should provide access to pay stubs, time off balances, year-end tax forms, and more.

Employment options.

Will you be employing contractors or full-time employees? While some packages are only designed for one or the other, there is software available that is capable of performing payroll for both full-time and contract employees. Depending on your business, you will want to choose payroll software that has flexible employment options.

Mobile access.

For convenience and easy access, consider software that offers a mobile app or a mobile-friendly website. This feature is ideal for businesses that have different office locations and teams.

New hire reporting.

Look for payroll software that automatically reports new hires to the New Hire Reporting department in your state.

Payroll reports.

For a more detailed analysis of your business's payroll, make sure the payroll software you choose has good reporting functions. This should be able to provide wage and labor reports, tax payment reports, and payroll summary reports.

Notifications.

Notifications help with the efficiency of your payroll process. Search for payroll software that offers email and SMS alerts, reminders, and push notifications.

Security.

You will be managing sensitive company and employee information. Look for payroll software that offers strong security features, such as password protection, secure storage, and limited access control.

5. Make use of free trials.

While payroll software may seem ideal on paper, you will need to test the software to ensure that it meets your payroll needs. If you're weighing a number of payroll software options, consider signing up for free trials. While the features and usability of free trials are often limited, they provide you with the basic tools to help you decide if the software is able to keep up with your business's payroll demands.

Payroll companies that offer free trials:

6. Determine your payroll budget.

For many business owners, the payroll budget will be a vital part of the decision-making process. Your final costs will depend on the software you choose and the payroll demands of your business. According to our research, you can pay as little as $20.00 to several hundred dollars per month for payroll software. Generally, you are charged a base fee to use the software, additional fees to use certain features, and a per-employee fee.

Tip: Check to see if any of the features you require cost extra, and get prices for the specific number of employees you'll have.

Cost Breakdown:

- Base fee: This will be the fee for a subscription. Be sure to find out which features are included in this price.

- Taxes and compliance: Find out if the payroll software charges an additional fee for support with taxes and other types of compliance. May include fees for W-2 printing, mailing, and reporting.

- Pay runs: Your payroll software will either charge a base fee for how often you’re administering payroll or the number of workers you’re administering payroll for.

- Setup fees: Depending on the payroll software you choose, you may be liable for installation fees.

- Miscellaneous: Some payroll software services charge more for direct deposits, per-envelope stuffings, and check signings.

7. Read through customer reviews.

A great way to determine the quality of payroll software is by reading through customer reviews. This will help you get first-hand advice from customers who have already purchased the software. Reviews will often list the pros and cons of each software. Payroll software with an overwhelming number of bad reviews may need another evaluation.

8. Choose payroll software.

Weigh the pros and cons of each payroll software you've researched and determine which software suits your requirements, budget, employee needs, and your type of business.

Best Payroll Software for Your Business:

Business | Payroll Software |

|---|---|

For Most Businesses | We recommend Gusto. This comprehensive software has a range of features including automatic tax payroll processing, digital pay stubs, contractor payments, and more. |

Law Firm | For law firms, we suggest Checkmark Payroll. This all-in-one solution allows unlimited payroll processing, contractor payments, and compliance management. |

Daycare/Babysitting Service | We suggest Wave Payroll. This software is great for freelancers and small businesses. Offers employee self-service, payroll management, and accounting integration. |

Restaurant | We recommend SurePayroll for restaurant owners. The software offers mobile access, integration with time clock systems, leave tracking, and more. |

Medical Practice | For medical practices, we recommend Namely, a robust HR and talent management solution that offers good payroll features, such as digital pay stubs and leave tracking. |

Accounting Firm | We recommend ADP TotalSource, an all-in-one solution that offers good payroll management tools, including self-service terminals and integrations. |

How to Improve Your Payroll Process

Learn how to effectively improve your payroll process with these easy steps and frequently asked questions.

Feb 9, 2023

FAQs:

What should I look for in payroll software?

- Affordability.

- Ease of use.

- Features.

- Support.

- Security.

- Integrations.

- Payroll legislation compliance.

Can I do payroll myself?

Yes, anyone can administer payroll. However, depending on the software you choose and the type of business you have, you may need additional training and knowledge to perform payroll accurately.

What features should my payroll software have?

- Reporting.

- Tax filing.

- Direct deposit.

- Integrations.

- Self-service portal.

- Mobile access.

Why are integrated HRMS payroll systems so popular?

Integrated HRMS payroll systems improve the accessibility of data by collating information that would otherwise be dispersed across separate frameworks. Combined with their automating features, this saves time, improves the ease and accuracy of reporting, and promotes seamless accounting.

How much should I pay for payroll services?

The costs associated with payroll services depend on the type of business, a number of employees, and software that you choose. You can either make use of free payroll software or you can pay up to $200 a month. Large companies with high numbers of employees can expect to pay more for robust payroll software.

Why do I need a payroll service?

If you have multiple employees and need to pay salaries on a bi-weekly or monthly basis, you may need payroll software to automate processes.

What does payroll software do?

Payroll software helps with paying employees for time worked. The software will automate time-consuming tasks such as drawing up paychecks, complying with tax regulations, direct depositing funds, and more. See our list of the best payroll software.