What is Certified Payroll?

Learn about certified payroll, what it is, how it works, and how to fill in a WH-347 form. Includes H-347 form download.

Updated on May 29th, 2023

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

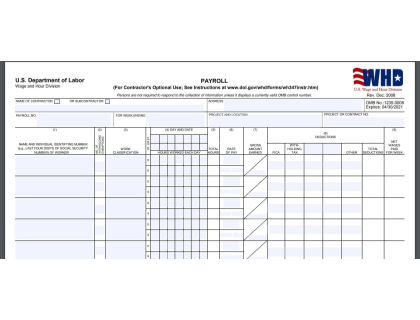

Certified Payroll is a federal WH-347 payroll form that is submitted weekly by employers working on federally funded projects. A WH-347 form should be completed for every contracted work week and provided to the firm overseeing your contract.

The form lists personal details about every worker on the project, hours worked, wages, and benefits. The form also includes a compliance certificate.

Form WH-347 Download:

Download Form WH-347 as a fillable PDF.

How Does Certified Payroll Work?

To comply with the Department of Labor (DOL) requirements, employers must submit a signed WH-347 certified payroll report for every week the company performs contract work in addition to the standard business payroll forms.

If your company is a subcontractor, you should submit your report to the main contractor. If your company is the main contractor, you should submit the certified payroll report to the federal agency contracting the project.

Best Small Business Payroll Software [2024]

Compare different payroll software options, including leading competitors Gusto, TriNet Zenefits, and QuickBooks Payroll. See reviews, pricing info, and FAQs.

May 31, 2024

What is Certified Payroll for Prevailing Wage?

Payroll that is certified for the prevailing wage is payroll that has been submitted with a federal form to certify that wages paid meet the standard set by the Government as outlined in the Davis-Bacon act.

What is Required for Certified Payroll?

A payroll report is deemed certified when it has a signed statement of compliance. This indicates that the WH-347 form is complete and correct, and that employees have been paid no less than the indicated Davis Bacon prevailing wage.

When the head of payroll or the company owner puts their signature on the certified payroll statement of compliance, they do so with the understanding that any willful falsification of payroll information may be subject to prosecution.

Who Needs to Submit Certified Payroll?

A certified payroll WH-347 form must be submitted by any contractor or subcontractor working on a project that is partially or fully funded with federal money. The value of the contract should also exceed $2,000. Detailed instructions on how to fill in a WH-347 form can be found below:

Instructions for Completing Form W-347:

Contractor or Subcontractor:

Fill in your company name and check the appropriate box.

Address:

Fill in your company's address.

Payroll No:

List the appropriate payroll number. If this is your first time submitting certified payroll, start with 1.

For Week Ending:

Enter the end date of the current workweek.

Project and Location:

Identify the project and enter the city and state where the project is located.

Project or Contract No:

Enter the appropriate contract number.

Column 1 - Name and Identifying Number.

Enter the full name of each worker and their identifying number. You can use the last four digits of their social security number.

Column 2 - No. of Withholding Exemptions.

This column is optional. If you want to fill it out, it will reflect on the workers' W-4 form.

Column 3 - Work Classifications.

List the classification descriptive of the work performed by laborers or mechanics.

Column 4 - Hours Worked.

Enter the day and date for hours worked. Fill in the appropriate boxes for straight time and overtime.

Column 5 - Total.

Add up the straight time and overtime hours worked and enter the total.

Column 6 - Rate of Pay (Including Fringe Benefits).

Enter the hourly rate paid for straight time work plus cash paid in lieu of fringe benefits.

Column 7 - Gross Amount Earned.

Enter the gross earnings for the project.

Column 8 - Deductions.

List deductions in the five boxes provided.

Column 9 - Net Wages Paid for Week.

Subtract deductions from gross earnings and enter the amount.

Using Payroll Software:

Creating certified payroll reports is made easier when you use payroll software. Many payroll software systems, including RUN Powered by ADP and QuickBooks, can automate the certified payroll process and eliminate double entries and miscalculations on hours worked, job codes, and pay rates.

Best Free Payroll Software for 2024

Discover the best free payroll software with features and reviews. Includes comparisons between top picks Gusto, TriNet Zenefits, and QuickBooks Payroll.

Jan 6, 2024

FAQs:

What is certified payroll?

Certified payroll is a federal WH-347 form that must be submitted weekly to the agency overseeing a federal government contract.

How does certified payroll work?

If you are an employer working on a federal contract, you are required to submit a signed WH-347 certified payroll report for every contracted work week. The form list details about every worker on the project including the number of hours worked and wages earned.

Where can I get certified payroll forms?

You can download Form WH-347 from the U.S. Department of Labor website.

Who must complete certified payroll forms?

A certified payroll report must be submitted by any contractor or subcontractor working on a project that is fully or partially funded by federal money, provided the contract exceeds the amount of $2,000.

What is the Davis Bacon act?

The Davis Bacon act is a United States federal law establishing the requirement for prevailing wages on public works projects. The act applies to contractors and subcontractors working on federally funded contracts exceeding the amount of $2,000.

Does certified payroll have to be paid weekly?

Yes, all certified payroll employees must be paid weekly.

Does QuickBooks do certified payroll?

Yes, from the QuickBooks report menu, choose "Employees & Payroll," then "More Payroll Reports in Excel," then "Certified Payroll Report."

Does certified payroll need to be notarized?

No, but it does need to be signed by the payroll manager or the company owner.

How much do certified payroll professionals make?

According to payscale.com, the average Certified Payroll Professional in the United States makes $68,000 per year.

Is certified payroll the same as prevailing wage?

Certified payroll and prevailing wage are two different things, but they are related. The prevailing wage is the fair wage specified for federal contractors in the Davis-Bacon act. Certified payroll is payroll submitted with a federal form to certify that the appropriate prevailing wages have been paid.