Double Entry Accounting

Find out what Double Entry Accounting means. Includes examples, steps, and frequently asked questions.

Updated on November 10th, 2021

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

Double-entry accounting is a method of accounting that makes simultaneous entries in two different accounts to balance debits and credits. Double-entry accounting helps to ensure accuracy and highlight errors in business accounts.

Typically, double-entry accounting involves entering one item on the left-hand side as a debit, with another equal item on the right-hand side as a credit.

How Double-Entry Accounting Works:

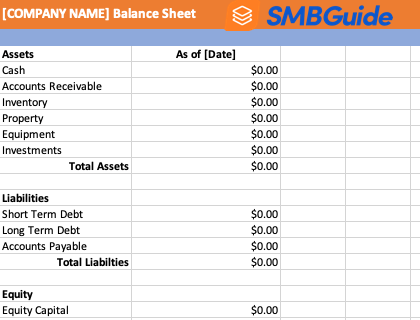

Most companies use a balance sheet as part of their bookkeeping to keep a record of assets, liabilities, and equity at any given time. Assets increase when they are debited, and liabilities increase when they are credited. Assets include things like equipment, cash, inventory, and so on. Liabilities include bank loans, accounts payable, and any other forms of debt.

A single transaction can represent both an asset and a liability, which is where double-entry bookkeeping comes in. For example, if your business secures a bank loan for $20,000, the loan is debited under "Assets" on your balance sheet because it represents an increase in your assets. At the same time, you can add a credit of $20,000 to your liabilities because the loan represents a sum of money that is owed to another party and must eventually be paid back.

Using the double-entry method, accountants and bookkeepers can ensure that the formula for equity, Assets = Liabilities + Equity, remains balanced.

If you use accounting software, there are many programs that do double-entry accounting automatically. QuickBooks, Wave, and Xero all offer double-entry features.

Best Accounting Software

Information on the best accounting software companies, including Freshbooks, QuickBooks, and Sage. See pricing, features, comparisons, and more.

Dec 21, 2023

Balance Sheet Template - Free Download

Use our balance sheet template in Excel to track your assets and liabilities.

Best Free Accounting Software

Compare top brands offering free accounting software, including ZipBooks, Expesify, Harvest, and more. Includes info on free offers, user reviews, and FAQs.

Dec 21, 2023

FAQs:

What are the principles of double-entry accounting?

The underlying principle of double-entry accounting is that there are always two entries for each transaction.

Do you have any double-entry accounting examples?

One good example is when a business uses cash to purchase an item. Say ABC Inc. spends $1,000 cash to buy a computer. This transaction affects the company's assets in two different places. First of all, ABC's cash assets must be credited $1,000 since the cash has decreased by that amount. However, the equipment assets can be debited $1,000 since they have gone up in value by $1,000.

Who invented double-entry accounting?

According to NPR.org, double-entry has its origins in the 1400s when it was used by merchants to keep an accurate record of the goods that they sold. The concept was discovered and formally documented by Luca Pacioli, a monk from Venice who included double-entry in his encyclopedia on math in 1494. It is believed that the publication of Pacioli's book helped to popularize the idea of double-entry bookkeeping.

What are the two rules of double-entry accounting?

Double-entry accounting has just one rule: in every transaction, an equal amount of money is transferred from one account to another.

Why do we do double-entry accounting?

Double-entry accounting is used to accurately reflect the true sum of assets and liabilities in a company, and to help avoid accounting errors by highlighting any discrepancies on the balance sheet.

How do you understand double-entry?

The easiest way to understand double-entry accounting is to consider that every transaction has both a benefit and a cost. For instance, a company may have to part with some of its assets (cash) to acquire new assets, or it may have to spend some assets to reduce its liabilities.

What are the disadvantages of the double-entry system?

While double-entry accounting has many advantages, it is also more complex than other methods of bookkeeping. If your accounts are being managed manually, this will require the use of more books to track transactions. However, most accounting software makes the double-entry method easier by helping to automate records.