Accrual Accounting

Learn what accrual accounting is and how it works. Includes frequently asked questions.

Updated on March 31st, 2020

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

Accrual accounting is an accounting method whereby a business's revenue and expenses are recorded in the business's financial statement when the business transaction occurs, regardless of whether payment has been received or made.

Businesses that keep inventory and corporations (except for S corporation status) with average annual gross receipts for the 3 preceding tax years that exceed $25 million are required to use the accrual method.

The other accounting method is cash basis accounting, which is more suited to small, cash-based businesses and sole proprietorships. Under this method revenues and expenses are only recorded once payments have been made or received.

Small Business Accounting

Learn how to set up a small business accounting systems with this step-by-step guide. Includes accounting software suggestions.

Dec 21, 2023

How Accrual Accounting Works:

1: Understand what accruals are.

Accruals refer to money a business owes or is owed.

For example:

When a customer purchases a product or service on credit, the business has not received money for the product yet and the amount the business is owed is classified as accrued income. Similarly, when a business makes a purchase on credit, the money the business still owes is an accrued expense.

2: Record accrued income.

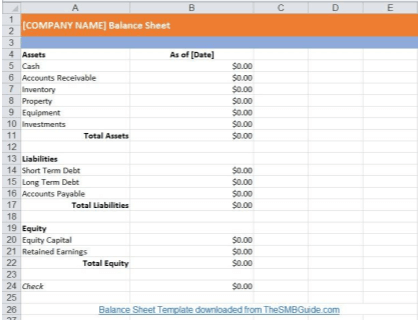

Accrued income is recorded at the time it is earned, regardless of when the business received the money it is owed. Accrued income is reported in the business's balance sheet as accounts receivable.

For example:

If a business provides a service on January 20th and the client only pays for the service on February 5th, the income is recorded as having been earned in January, despite the actual cash transaction occurring in February.

3: Record accrued expenses.

Accrued expenses are recorded as accounts payable in a business's balance sheet. Just like accrued income, accrued expenses are recorded at the time the financial commitment is made, regardless of when the cash transaction takes place.

For example:

When a business makes a purchase on credit, the purchase amount is recognized as an accrued expense and recorded as having been incurred at the time of the purchase agreement, regardless of when the payment is made.

Best Accounting Software

Information on the best accounting software companies, including Freshbooks, QuickBooks, and Sage. See pricing, features, comparisons, and more.

Dec 21, 2023

Pros and Cons of Accrual Accounting:

Pros

- Provides a more accurate picture of the current financial position.

- Allows for easier forecasting, planning, and managing of resources.

- [GAAP]({entry:87965}) compliant.

Cons

- Taxes are paid for recorded income, regardless of payment status.

- Complex and difficult to maintain.

Balance Sheet Template - Free Download

Use our balance sheet template to record your expenses and liabilities, revenues and assets.

Best Free Accounting Software

Compare top brands offering free accounting software, including ZipBooks, Expesify, Harvest, and more. Includes info on free offers, user reviews, and FAQs.

Dec 21, 2023

FAQs:

What is an example of an accrual?

Any income or expense a business has for which payment has yet to be received or paid is an accrual. For example, the electricity a business uses to operate, the total consumption of which is only billed to the business at the end of the month to be paid at some point in the following month, is an accrued expense.

What is the difference between cash and accrual accounting?

The difference between cash basis and accrual accounting is that cash accounting records incomes and revenues when cash is exchanged while accrual accounting records incomes and revenues the moment they are incurred regardless of whether payment has been made or received.

Why is accrual accounting important?

Accrual accounting provides businesses with a more accurate picture of their current financial situation than cash accounting can and allows businesses to better assess the profitability of their operations and manage resources.

Who uses accrual accounting?

Most businesses use accrual accounting. Businesses with inventory and corporations whose annual sales exceed $5 million are required to use the accrual method.

What is the principle of accrual accounting?

The principle of accrual accounting is to record revenue and expenses when they are incurred regardless of the time of payment.

Can you use both cash and accrual accounting?

In some cases, businesses can use a hybrid method, which is a blend of cash-basis and accrual accounting. There are special IRS rules that must be followed when using this method. For example, income and expenses must be recorded using the same method, either accrual or cash basis accounting.

Does IFRS require accrual accounting?

The International Financial Reporting Standards (IFRS) advocates the accrual accounting method for recording revenue and expenses.