What is Cost Accounting?

Learn about what cost accounting is and how it works. Includes a free cost sheet template and frequently asked questions.

Updated on September 27th, 2021

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

Cost accounting is a type of managerial accounting used in budget preparation, profitability analysis, and optimization of business operations based on cost-efficiency. It is the practice of identifying, measuring, and analyzing all fixed and variable costs associated with performing services, the manufacturing process, and the supply chain.

Unlike financial accounting, which reports to external bodies, cost accounting is used as an internal tool, which means that it does not need to meet Generally Accepted Accounting Principles (GAAP) and can vary by business and department.

Measuring costs is essential to determining gross profit and helps businesses set sales prices and identify opportunities to improve the cost-efficiency of their operations.

How Cost Accounting Works:

Cost accounting is the process of recording all costs associated with the production of products or performance of services and determining the total cost of producing an item or delivering a service.

The basic equation for calculating cost per unit is to divide the total manufacturing costs (including fixed and variable costs) by the total number of units produced within a specified time frame.

Sample calculation:

If you manufacture luxury kitchen units, your costs will include raw materials, staff salaries, rent, and utilities. You may also have additional expenses, such as insurance, marketing, and equipment maintenance.

Let's assume you manufacture and sell an average of 60 kitchen units per month and incur the following expenses:

- $1,500.00 for monthly rent.

- $700.00 for utilities per month.

- $70.00 for raw materials per unit.

- $2,500.00 per employee per month.

Using cost accounting, you can now calculate the cost per unit:

Rent: $1,500 per month / 60 kitchen units = $25.00 per kitchen unit

Utilities: $700 per month / 60 kitchen units = $11.67 per kitchen unit

3 Employees: (3*$2,500 per month) / 60 kitchen units = $125.00 per kitchen unit

Raw materials: $70.00 per kitchen unit

The total cost of manufacturing a kitchen unit is $231.67.

If you have other expenses, such as marketing, you would divide that monthly expense by the number of units produced per month to determine the cost of marketing per unit and add it to the total cost per unit.

Analyzing expenses according to the type of costs helps you to identify your major cost contributors and how to price your products and increase your profit margin.

In our example, the direct labor and raw materials present the biggest expenses. You may want to investigate whether there is an opportunity to improve operational efficiency for higher production rates or to look for a raw materials supplier that offers lower rates than your current supplier.

Small Business Accounting

Learn how to set up a small business accounting systems with this step-by-step guide. Includes accounting software suggestions.

Dec 21, 2023

Related accounting formulas:

Calculate the point at which your total costs are covered by your total revenue:

Break Even Point = Fixed costs / (Unit selling price - Variable costs)

Calculate the marginal profit per unit sold:

Contribution Margin = Sales Revenue - Variable Costs

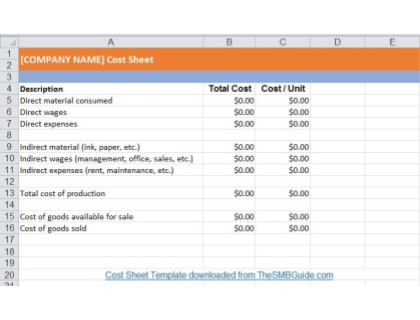

Cost Sheet Template - Free Download

Download a free Cost Sheet template in Microsoft Excel format.

Types of Cost Accounting:

Standard Costing.

Standard costing essentially determines the budgeted or standard production cost based on historical data. This can then be compared to the actual costs incurred in the process of manufacturing the goods to be sold.

The discrepancies between the two costs are known as variances and provide an indication of the current situation and expected profits. A variance is favorable when the actual costs are lower than the standard costs and unfavorable when the actual costs are higher than the standard costs.

The advantages of standard costing are that management can focus on other important tasks as long as the variance is favorable and, if the variance is unfavorable, are quickly alerted to operational issues and can investigate and address the cause.

Job Order Costing.

Job order costing is used to track the costs associated with producing and delivering unique or custom products or services that tend to be more costly and differ from each other significantly. This method requires that a separate cost record is created for each job, detailing the direct labor and materials used. The cost record will also include an assigned portion of overhead costs.

The benefit of job order costing is the ability to determine the profits made on individual jobs which also helps businesses identify which product or service lines may be worth expanding or investing in. In addition, job order costing allows businesses to track the performance and efficiency of individuals and teams.

Activity-Based Costing.

Activity-based costing (ABC) is used to assign the overhead costs of production to individual activities and activity pools that form part of the production process. The ABC method can be used to reduce overhead costs by identifying activity-based cost drivers.

Activity-based costing allows for more precise and reliable product costing as overhead costs are traced to specific activities. This, in turn, allows businesses to identify any activities that are inefficient or do not add value to the product or service.

Marginal Costing.

Marginal costing is used to determine the variable cost of producing an additional unit or product. Businesses can then identify at what point they can achieve economies of scale and optimize their manufacturing processes and general operations accordingly.

This method of costing essentially looks at the variable costs to inform short-term decisions, providing an understanding of how profit margins fluctuate due to production volume.

Lean Accounting.

Lean accounting focuses on a business's value streams, assessing the costs and benefits of each step in the value chain. Lean accounting is used to reduce waste and optimize processes by implementing lean performance measures.

Variance Analysis.

Variance analysis is concerned with reviewing, investigating, and determining the causes of the differences between budgeted and actual costs. Variance analysis is a valuable tool for improving budgeting activities and helps businesses understand the cause of income and cost fluctuations.

Types of Costs:

Understanding the distinctions between the type of costs a business incurs helps managers and business owners understand cost figures and drivers.

Fixed costs.

Fixed costs are consistent expenses that remain the same regardless of production and sales volume. Rent, for example, is a fixed cost that is not influenced by increases or decreases in production.

Variable costs.

Variable costs, on the other hand, are costs that are linked to the changes in production levels, such as raw materials.

Operating costs.

Operating costs refer to the costs associated with maintaining production facilities and machinery and any other expenses for resources and activities needed to run the daily operations of a business.

Direct costs.

Direct costs are costs that can be clearly allocated to a product. The wood used to build a kitchen unit, for example, is a direct cost attributed to the kitchen unit.

Indirect costs.

Indirect costs cannot be clearly allocated to a specific product or activity, such as the cost of Internet data or telephone bills.

How to Find a Small Business Accountant

Learn more about how to find a small business accountant. Includes easy-to-follow steps and frequently asked questions.

Sep 17, 2023

FAQs:

What is cost accounting?

Cost accounting refers to the practice of identifying, measuring, and analyzing all costs associated with the manufacturing of products. It is a type of managerial accounting used to analyze and optimize business operations in terms of cost-efficiency.

What are the types of cost accounting?

The most common types of cost accounting include the following:

What are the types of costs?

What are the elements of cost accounting?

Cost accounting is used to determine the value of a product or service based on three cost elements, namely labor, materials, and overhead expenses.

What is the limitation of cost accounting?

The lack of a uniform cost accounting system and the use of estimation and previous data present major limitations. Implementing a cost accounting system can also be expensive and result in the duplication of accounting work.

Why is cost accounting important?

Cost accounting allows businesses to understand precisely how money is spent and to identify ways to reduce expenses and optimize production processes.

What is the difference between cost accounting and financial accounting?

Cost accounting is an internal process concerned with tracking and analyzing costs associated with the supply chain and production processes of business, while financial accounting is concerned with all financial transactions and data or an organization, and reports to external bodies.