Balance Sheet

Learn how to create a balance sheet for your business. Includes a free download and frequently asked questions.

Updated on October 4th, 2021

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

A balance sheet lists a company's assets, liabilities, and shareholder equity. Balance sheets are used to show the net worth of a business and can be used to compare year-over-year performance. Balance sheets can be used to report to shareholders and attract new investors.

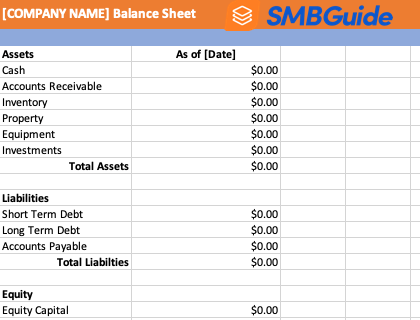

Balance Sheet Template - Free Download

Use our balance sheet template in Microsoft Excel format to get started on a balance sheet for your business.

Accounting Software

FreshBooks Accounting Software

Simplify your accounting tasks with Freshbooks accounting.

No credit card required.

Cancel anytime.

What to Include in a Balance Sheet:

Balance sheets are made up of three sections: assets, liabilities, and shareholder's equity.

1. Assets.

An asset is anything that your company owns that is cash or could be sold for cash if necessary. This includes cash (obviously), inventory, accounts receivable, and equipment. Assets are sometimes further divided into current and long term, with current being things like cash and long term being real estate or equipment that is needed to run the business.

2. Liabilities.

Liabilities represent money that is owed. This can include things like debt, rent, utilities, wages, accounts payable, etc.

3. Shareholder's Equity.

Equity in your business that is owned by the shareholders. Shareholder's equity can also be called "net assets" since it is really the difference between the assets and the liabilities.

FAQs:

What's included in the balance sheet?

A full balance sheet includes a company's assets, liabilities, and shareholder equity.

What is the balance sheet total?

The total at the bottom of a balance sheet is the difference between a company's assets (current and fixed) and liabilities, including shareholder equity. The total shows the net worth of the business.

How does a balance sheet balance?

On the balance sheet, assets should always be equal to the total of liabilities plus shareholder's equity. This is because acquiring an asset, like a new piece of equipment, may also cause you to take out a loan, which represents debt. The loan is a liability, but the newly acquired equipment is an asset.

What is the purpose of a balance sheet?

A balance sheet summarizes the financial status of a company. By displaying assets, liabilities, and shareholder equity, a balance sheet makes it easy to determine the true worth of a company. A balance sheet can also be useful when comparing one financial period to the next.

What does not appear on a balance sheet?

Sometimes intangible assets are excluded from a balance sheet. Intangible assets are assets that have been generated by a business rather than being acquired by some other means.