What is Managerial Accounting?

Find out what managerial accounting is, how it works, and the different types of methods. Includes frequently asked questions.

Updated on October 6th, 2021

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

Managerial accounting, also known as management accounting, refers to the process of collecting, measuring, analyzing, and presenting financial information to managers. The purpose of managerial accounting is to help managers control and optimize business operations.

Since managerial accounting is used for internal purposes only, it is not required to conform with accounting standards, such as GAAP.

What is GAAP?

GAAP stands for Generally Accepted Accounting Principles and constitutes a set of accounting standards and rules issued by the Financial Accounting Standards Board (FASB).

How Managerial Accounting Works:

Accounting information for internal management.

The purpose of managerial accounting is to provide a business's internal management with relevant information to help managers with the formulation of policies, budgeting, controlling, and performance and risk management. This information is comprised of both financial and non-financial data pertaining to the business's operations and its economic context.

Role of the managerial accountant.

The managerial accountant is responsible for sourcing, analyzing, and reporting financial and non-financial information relevant to business decisions and the business's capability to generate revenue and maintain profitability.

The managerial accountant will collect relevant financial and non-financial information and use different accounting methods and techniques to process it. Beyond crunching numbers, managerial accountants also seek to identify and understand the reasons for and influences on profits and losses. To do so, they may use a variety of different accounting methods and techniques, including cost accounting, inventory analysis, constraint analysis, trend analysis, and forecasting.

Managerial accounting and decision-making.

While managerial accountants are not the decision-makers, they help drive business decisions based on data and insights. Management uses the information presented in the managerial accounting reports to set targets, manage performance, identify efficient and inefficient areas of the business operations, develop and implement corrective measures and controls, create budgets, and more.

Global Management Accounting Principles

In 2014 the Chartered Institue of Management Accountants (CIMA) together with the American Group of CPAs (AICPA) and government bodies, regulators, accounting and business professionals from 20 countries established a set of Global Management Accounting Principles (GMAP) to guide managerial accounting practice.

Small Business Accounting

Learn how to set up a small business accounting systems with this step-by-step guide. Includes accounting software suggestions.

Dec 21, 2023

Types of Managerial Accounting Methods:

A variety of different accounting methods and techniques are used in the managerial accounting process. Read on to learn about the most common methods.

1. Cost Accounting:

Cost accounting is used to measure and analyze all fixed and variable costs associated with the production of products or performance of services. There are several different types of cost accounting.

Common Types of Cost Accounting:

Standard costing | Standard costing is used to determine a standard or budgeted cost for producing products or delivering a service, which is then compared to the actual costs of operations. |

Job order costing | Businesses that provide customized solutions that differ significantly from each other can use job order costing to compute the costs associated with each unit of output. A job costing sheet or cost record is created per custom job to record only job-specific costs. |

Activity-based costing | Activity-based costing (ABC) is a system for allocating indirect costs to specific activity pools. For each activity, such as product design, an activity measure, for example, the time spent working on a design, is identified and used as cost driver to assign specific overhead costs to a product or service. |

Marginal costing | Marginal costing is used to determine the cost of producing an additional unit in order to identify at which volume the production costs per additional unit are the lowest. Marginal costing essentially reveals the relationship between cost, volume, and profit which can be used to determine the break-even point, optimum production volume, and the optimal sales mix. |

Variance analysis | Variance analysis is used to assess a business's performance by comparing the planned or budgeted costs with the actual costs and identifying what is causing any deviations. |

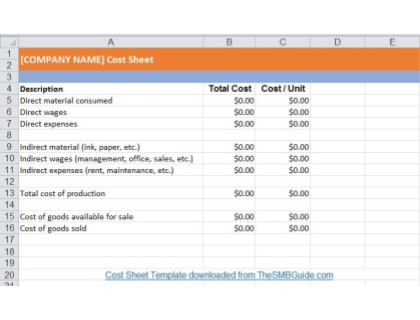

Cost Sheet Template - Free Download

Download a free Cost Sheet template in Microsoft Excel format.

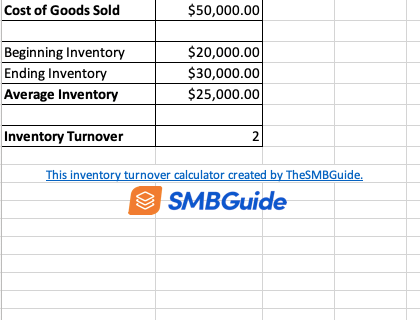

2. Inventory Turnover Analysis:

Inventory turnover is the measure of the inventory a business sold or used within a given time period. Calculating the turnover ratio of inventory reveals how fast inventory is turned into revenue and helps businesses manage their inventory more efficiently, ensuring that inventory levels are neither too high or too low to meet demand.

How to calculate the inventory turnover:

Inventory Turnover = Cost of Goods Sold / Average Inventory

Inventory Turnover Calculator - Free Download

Use our Excel inventory turnover calculator to determine what your business's inventory turnover rate is.

3. Constraint analysis:

Constraint analysis is concerned with identifying limiting factors in a system and working to eliminate them. These constraints, also called bottlenecks, can be internal or external factors that limit the business's profitability. For example, if the availability of raw materials needed for production is very limited, this is a constraint that limits the business's production output.

Once a business has identified constraints or bottlenecks, it can evaluate them, investigate what is causing them, and determine whether steps can be taken to eliminate them.

4. Budgeting:

There are two main types of budgeting used in managerial accounting, namely capital and operational budgeting.

Capital Budgeting refers to the process of evaluating potential investments and projects, such as real estate, new equipment, or repairs to determine whether they are worth pursuing. Accountants use a variety of calculations to assess the value and return on investment the proposed capital investment offers.

Common Calculations used in Capital Budgeting:

Net Present Value | The difference between the present value of cash inflows and cash outflows over a given period of time. Only if the NPV is positive, is a proposed capital investment considered. The higher, the better. |

Payback Period | The time period required to recover the costs of the initial investment. The payback period can be calculated by dividing the expected cash flow per year by the initial investment. |

Rate of Return | The rate of return is a measure of the final profit or loss of an investment expressed as a percentage, calculated as follows: [(final value of the investment - initial value of the investment) / initial value of the investment] * 100. |

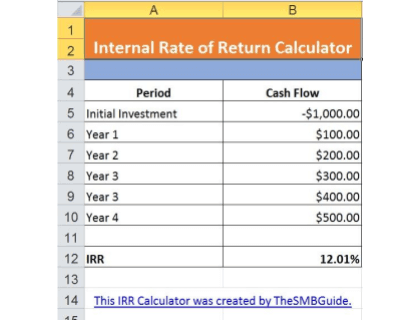

Internal Rate of Return | Also known as the discounted cash flow rate of return, the internal rate of return is used to evaluate a potential investment's profitability. The IRR is usually compared to the business's hurdle rate, which is the minimum rate of return the business would accept. The IRR can easily be calculated with a financial calculator or an excel spreadsheet. |

Internal Rate of Return Calculator - Free Download

Use our Excel internal rate of return calculator to determine an investment's internal rate of return.

Operating budgets are typically created on an annual basis and are concerned with estimating the expenses of maintaining daily operations at optimum levels as well as the expected revenue generated by the operations within a given budget period.

An operating budget provides a comprehensive overview of the business's operations and contains supporting documents that detail the budgets of the various business departments and functions, such as sales, production, and administrative support.

Typical Supporting Budgets:

Sales budget | Sales forecast and selling price per unit during the budget period. |

Production budget | Number of units to be produced and sold as well as the required inventory levels at the beginning and end of the budget period. |

Direct materials budget | Amount of direct materials to be purchased to meet production needs. |

Direct labor budget | Total costs of direct labor required for production. |

Overhead budget | Overhead costs associated with the production process. |

Selling and administrative expenses budget | Includes items such as sales commission, anticipated delivery costs, office supplies, etc. |

Operational budgeting helps businesses set specific financial goals and develop plans to achieve those goals. It also serves as a tool for overall performance analysis.

5. Trend Analysis and Forecasting:

Managerial accountants identify patterns and trends in historical data, investigate data fluctuations and variances, derive actionable insights, and make projections about future trends.

Trend analysis is also referred to as horizontal analysis and denotes the process of analyzing a business's financial statements over a given time period to map out trends and patterns of revenue and cost information.

Any fluctuations or inconsistencies that a trend analysis may reveal can be evaluated as to the possible causes and the impact on the business's profitability. This information, in turn, helps management with strategic decision-making and supports budgeting activities and the development of contingency plans.

Forecasting is used to make budget projections based on a comprehensive selection of information, including historical financial and sales data, the economic context and outlook, and customer trends. The information used to create a forecast can include both financial and non-financial data, giving consideration to contextual influences on a business's financial performance.

Best Accounting Software

Information on the best accounting software companies, including Freshbooks, QuickBooks, and Sage. See pricing, features, comparisons, and more.

Dec 21, 2023

Pros and Cons of Managerial Accounting:

Pros

- Focus is on planning for the future.

- Flexible and not required to conform with accounting regulations.

- Measures performance in comparison with budgets.

- Makes financial data palatable for decision-makers.

Cons

- Accuracy depends on the quality of data used.

- Subjective and open to manipulation.

- Lacks standardized procedures and benchmarks.

Best Free Accounting Software

Compare top brands offering free accounting software, including ZipBooks, Expesify, Harvest, and more. Includes info on free offers, user reviews, and FAQs.

Dec 21, 2023

Managerial vs Financial Accounting

Managerial Accounting | Financial Accounting |

|---|---|

Created for internal management purposes. | Created for external parties (shareholders, lenders, public regulators). |

Not subject to specific accounting rules. | Must conform with U.S. GAAP. |

Uses financial and non-financial performance measures. | Focuses on financial performance measures. |

Information is forward-looking. | Information is historical. |

Often presents information about specific departments or products. | Presents overall company information. |

FAQs:

What is the main focus of managerial accounting?

The key focus of managerial accounting is to support internal management with planning for the future. Managerial accounting reports provide managers with financial and contextual information regarding the business to guide the decision-making process.

What is an example of managerial accounting?

Using constraint analysis to identify bottlenecks in a business's operations is an example of managerial accounting. For example, a constraint analysis may reveal that the slowing rate of sales in spite of increased demand is due to an insufficient number of trained sales staff available. Business managers can then make the appropriate decisions to eliminate the constraint.

What are the functions of managerial accounting?

The functions of managerial accounting encompass the sourcing, analyzing, and reporting of financial and non-financial information to be used for internal business decision-making and planning activities.

What is managerial accounting?

Managerial accounting refers to the process of collecting and analyzing a business's financial information as well as contextual data and preparing reports for internal management. The purpose of managerial accounting reports is to support and guide planning and operational management activities.

What are managerial accounting methods?

What is managerial accounting vs financial accounting?

Managerial accounting, in contrast to financial accounting, is not bound by accounting standards and regulations and is used only to support internal management decisions. Financial accounting, on the other hand, serves to inform the business's external stakeholders and must comply with accounting regulations, including GAAP.

Does managerial accounting follow GAAP?

No, managerial accounting is not required to follow GAAP.