Mileage Reimbursement for Employees

Learn more about mileage reimbursement for employees. Includes FAQs and a free employee mileage reimbursement form for download.

Updated on January 25th, 2022

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

Many companies use mileage reimbursement programs to repay employees for driving their own vehicle for business purposes. In the United States, most employees are reimbursed on a per-mile basis at a rate set by the IRS.

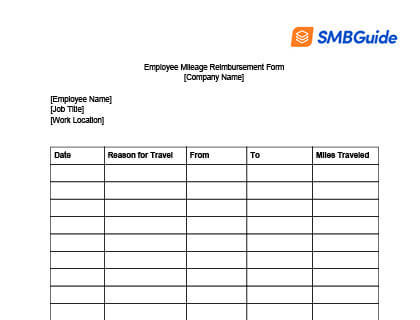

Employee Mileage Reimbursement Form:

Download a free sample employee mileage reimbursement form in Word format.

Sample Employee Mileage Reimbursement Template:

Download our free mileage reimbursement for employees template in PDF format.

Mileage Reimbursement Software:

- One-time reimbursements.

- Recurring reimbursements too.

- Reimburse via payroll.

IRS Mileage Reimbursement Rules for Employees:

According to the IRS employee mileage reimbursement policy, a company's employee mileage reimbursement program must include the following three rules:

- An employee must have paid or incurred expenses that are deductible while performing services for your business.

- An employee must provide an adequate account to you as the employer, for these expenses within a reasonable time period.

- As the employer, you must return any excess reimbursement or allowance within a reasonable time period.

If your mileage reimbursement policy does not meet all three requirements, your plan will be considered non-accountable, and your employee's reimbursed monies should then be included on his/her Form W-2. In this case, you must report the payments as income.

Many companies use payroll software to help them reimburse employees for miles.

FAQs:

Are employers required to reimburse employees for mileage?

This depends on where you're from. In some states, employers are required by law to reimburse employees for using their own car or a rental vehicle for business purposes. As a rule of thumb, many companies do have an employee mileage reimbursement policy to keep their employees happy.

Most companies use the IRS rate for business travel as it's considered fair, but some companies have adopted a fixed-rate program where employees are charged a flat rate each month.

What is the current mileage rate for 2019?

The employee mileage reimbursement rate for 2019 is $0.58 per mile for regular business driving. The rate for non-profit employee mileage reimbursement is $0.14 per mile.

How is employee mileage reimbursement calculated?

To work out how much mileage reimbursement should be for an employee, multiply the number of miles your employee has claimed by the IRS rate of $0.58.

What is the legal minimum mileage reimbursement?

At this time there are no federal laws that require businesses to reimburse employees for their mileage. California and some other states have requirements for employee mileage reimbursement.

Can I reimburse a contractor for mileage?

You should only reimburse contractors for mileage if you are not reimbursing them for other expenses such as equipment costs and e-mail, phone, and software expenses.

What will companies pay for mileage in 2019?

From January 1, 2019 the IRS's 2019 standard mileage rate is 58 cents per mile for regular business driving.