Contribution Margin: What it is and How to Calculate it

Find out what a contribution margin is, why it is important, and how to calculate it. Download a free spreadsheet to make your calculations easier.

Updated on October 6th, 2021

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

What is a Contribution Margin?

The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company's break-even analysis.

A contribution margin analysis can be done for an entire company, single departments, a product line, or even a single unit by following a simple formula. The contribution margin can be presented in dollars or as a percentage.

Key terms associated with contribution margin:

- Variable costs: Costs that change along with changes in production volume and output.

- Sales revenue: The total income from the sale of goods or services.

- Fixed costs: These are the company's overheads. They are the costs that do not fluctuate along with changes in production volume and output.

- Profit: The money left over after all fixed costs have been paid.

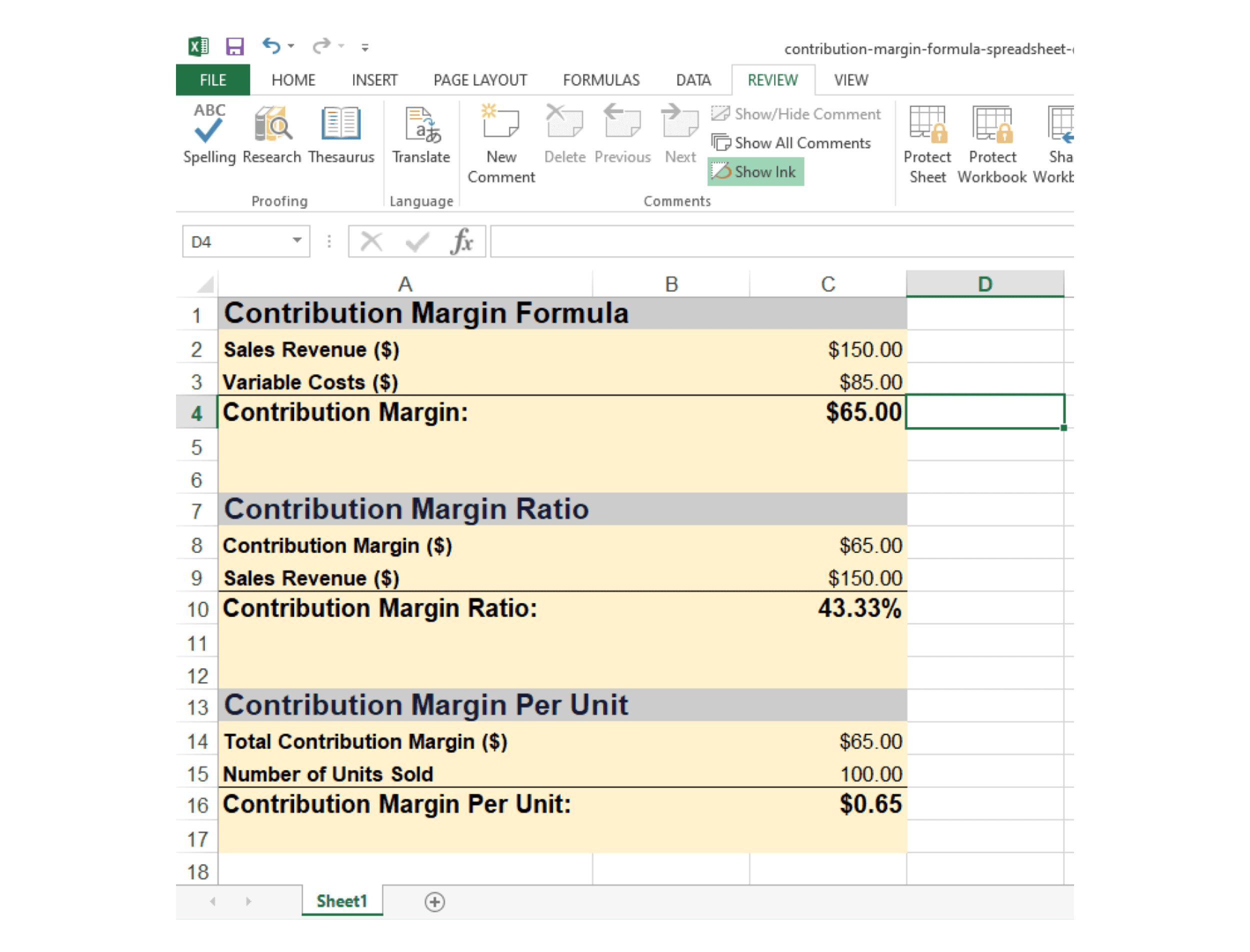

Contribution Margin Spreadsheet:

Calculate your Contribution Margin with this easy-to-use spreadsheet.

Contribution Margin Formula:

Contribution Margin = Sales Revenue - Variable Costs.

Example:

Your company sells 100 cupcakes at $1.50 each. It cost you $85 to make the 100 cupcakes. What is the contribution margin from the sale of all 100 cupcakes?

First, calculate the sales revenue.

100 cupcakes * $1.50 = $150.

Now, add up all the variable costs directly involved in producing the cupcakes (flour, butter, eggs, sugar, milk, etc). Leave out the fixed costs (labor, electricity, machinery, utensils, etc).

Variable costs = $85.

Finally, subtract the variable costs from the sales revenue.

$150 - $85 = $65.

The contribution margin from all 100 cupcakes is $65.

Contribution Margin Ratio:

While the dollar contribution margin shows you how many dollars are left over for fixed costs and profit, the contribution margin ratio gives you the percentage, showing the proportion of revenues available after variable costs have been paid.

Contribution Margin Ratio Formula:

Contribution Margin Ratio = Contribution Margin ÷ Sales Revenue.

Example:

Your company sells 100 cupcakes at $1.50 each. It cost you $85 to make the 100 cupcakes. What is the contribution margin ratio from the sale of all 100 cupcakes?

Calculate the contribution margin.

$150 - $85 = $65.

Now, divide the Contribution Margin by the Sales Revenue.

$65 ÷ $150 = 0.43.

The Contribution Margin Ratio is 43.3%.

Contribution Margin Per Unit:

Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business.

Contribution Margin Per Unit Formula:

Contribution Margin Per Unit = Total Contribution Margin ÷ Number of Units Sold.

Example:

Your company sells 100 cupcakes at $1.50 each. It cost you $85 to make the 100 cupcakes. What is the contribution margin from the sale of all 100 cupcakes?

Calculate the total contribution margin.

$150 - $85 = $65.

Now, divide the total contribution margin by the number of units sold.

$65 ÷ 100 = 0.65.

The contribution margin per cupcake is 65 cents.

FAQs:

How do you calculate the contribution margin?

You can calculate the contribution margin by subtracting the direct variable costs from the sales revenue.

Why is the contribution margin important?

The contribution margin helps you understand how much money a product, department, or an entire company is contributing to overheads and profit, and helps in decision-making about pricing, product volumes, sales strategies, etc.

What is a good contribution margin?

The higher the contribution margin ratio the better. It means there's more money for covering fixed costs and contributing to profit.

What is the contribution margin ratio formula?

Contribution margin ratio = (Sales revenue - variable costs) ÷ sales revenue.

What does the contribution margin tell us?

The contribution margin tells us whether the unit, product line, department, or company is contributing to covering fixed costs.

Is contribution margin the same as profit?

No. Contribution margin is the remaining earnings that have not been taken up by variable costs and that can be used to cover fixed costs. Profit is any money left over after all variable and fixed costs have been settled.

How do you calculate contribution margin on a calculator?

- Type in total sales revenue amount.

- Push '-'.

- Type in variable costs amount.

- Push '='.

What is the difference between the contribution margin ratio and contribution margin per unit?

The contribution margin ratio is the percentage of sales that isn't taken up by variable costs, while contribution margin per unit is the difference between the selling price of the unit and the variable costs that go into producing it.

What is the contribution margin per machine hour?

It is the monetary value that each hour worked on a machine contributes to paying fixed costs. You work it out by dividing your contribution margin by the number of hours worked on any given machine.

How do you calculate the weighted average contribution margin?

- Add up the number of sales from all product lines.

- Add up the contribution margins for all product lines.

- Divide the total contribution margin by the total number of sales.

Is a high contribution margin ratio good?

Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits.

How do you maximize your contribution margin?

- Raise prices.

- Lower variable costs.

How do you find the contribution margin per direct labor hour?

You work it out by dividing your contribution margin by the number of hours worked.

What affects the contribution margin?

The contribution margin is affected by the variable costs of producing a product and the product's selling price.

How does the contribution margin affect profit?

The contribution margin is the leftover revenue after variable costs have been covered and it is used to contribute to fixed costs. If the fixed costs have also been paid, the remaining revenue is profit.