What is Payroll Register? Guide + Free Excel Download

Learn what a payroll register is, what it includes, and get a totally free Excel download for creating a payroll register — we won't even ask for your email.

Updated on August 4th, 2022

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

A payroll register is a business document that summarizes employees' payroll activity for a specific period. It lists total information for employee payroll and includes gross pay, deductions, hours worked and net pay.

It will help your business with payroll tax deposits, submitting quarterly payroll tax reports on Form 941 to the IRS, and compiling annual tax and wage reports for employees and the Social Security Administration.

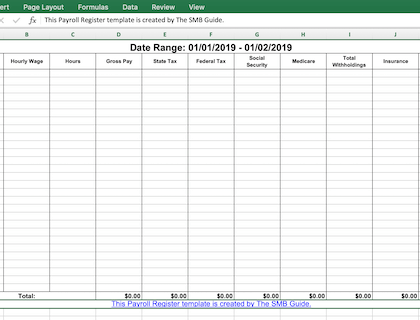

Free Payroll Register Template

Use this free Excel sheet download of a payroll register to get started creating your own register right away.

Payroll Register Payables:

Payables are amounts that your business owes to federal, state, and/or local agencies that have not yet been paid. It is essential to create categories of payables from the payroll register and ensure that you set aside funds for those payables.

Payables include:

- FICA tax (Medicare and Social Security).

- Federal income tax.

- State income tax.

- Local income tax.

- Federal unemployment tax payable.

- State unemployment tax payable.

- State Workers’ Compensation tax payable.

You can view our comprehensive guide on How to do Payroll and our guide to Business Tax Software.

FAQs:

What is included in a payroll register?

- Employee name.

- Employee number.

- Employee social security number.

- Gross pay.

- Net pay.

- Pay period.

- Pay rate.

- Federal, state, and local income taxes.

- Other deductions.

- Regular hours worked.

- Overtime hours worked.

- Other hours worked.

Is a payroll register the same as a payroll journal?

No. A payroll register includes information for individual employees, a payroll journal includes only company-wide payroll figures.

What formula can I use to calculate employee net pay?

Your employees' net pay is the final amount that they will get paid and can be calculated as follows: Gross Pay - Deductions = Net Pay.

What does it mean to prove a payroll register?

Once you have totaled up all figures in your payroll register, you will then need to prove that the grand total earnings = the grand total of deductions + the grand total of net pay. Basically, you will have to show evidence that your calculations are accurate.

What is the Medicare and Social Security tax rate for employees?

The Medicare tax rate for each employee is 1.45% while the Social Security tax rate for employees is 6.2% with a base limit of $132,900.

What is the difference between a payroll register and an employee earnings record?

A payroll register indicates the payroll activities of all employees for a specific period of time while an employee earnings record indicates the payroll activities of an individual employee for a specific period of time.

How long should I keep payroll register records for?

The IRS recommends that you keep payroll register records for at least four years in the event that your company is audited.

What is a payroll check register?

A payroll register is a business document that records all the payment details for employees during a specific period. It lists information about each employee and includes gross pay, deductions, hours worked and net pay.