How to Create a Payroll Ledger

Learn how to create a payroll ledger for your business. Includes frequently asked questions and a free template download.

Updated on November 5th, 2021

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

A payroll ledger is a document or spreadsheet that gives an overview of a company's payroll information. The ledger includes the names of staff members, salaries, overtime rates, etc.

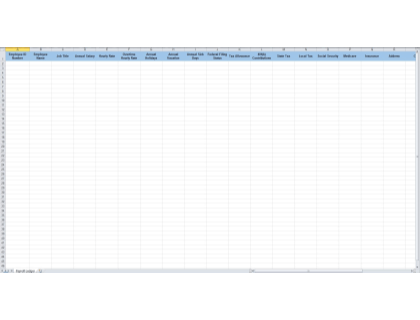

Payroll Ledger Template - Free Download

Use our payroll ledger excel spreadsheet to create your own ledger.

Our Payroll Software Pick

Gusto Payroll Software

Want to improve your payroll process now? Gusto automates and simplifies the process, while helping to ensure compliance.

No extra fees.

Auto tax filing and digital paystubs.

Handles benefits, time tracking, and compliance too.

How to Create a Payroll Ledger:

- Open a new spreadsheet.

- Label the first column "Employee Name."

- Label the second column "ID Number."

- Title the remaining columns with applicable items like rate of pay, overtime rate, etc.

- Include columns for "Gross Pay" and "Net Pay."

- Add the names and numbers of all of your current employees to the first two columns.

- Save the spreadsheet.

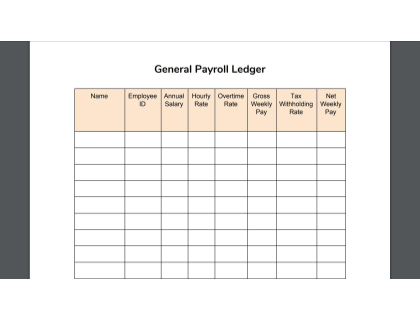

Payroll Ledger Sample - PDF Download

Use this payroll ledger form in PDF format to create a simple ledger for your business.

What is Certified Payroll?

Learn about certified payroll, what it is, how it works, and how to fill in a WH-347 form. Includes H-347 form download.

May 29, 2023

FAQs:

What is a payroll general ledger?

A general payroll ledger helps you to keep track of how much each of your employees is paid and how much taxes should be withheld from each paycheck.

How do I balance payroll to the general ledger?

- Create a payroll report for your most recent pay period.

- Compare employee time cards to your payroll ledger to make sure they match.

- Compare the rate of pay to make sure it is correct.

- Ensure that all deductions have been taken from paychecks.

- Enter information in your general ledger based on what is in your payroll summary.

What is a payroll ledger in QuickBooks?

You can use QuickBooks to create a payroll ledger. All of the information will automatically be uploaded to your ledger from your QuickBooks account. In QuickBooks, this is called a payroll summary report.

What is a payroll summary report?

A payroll summary report is the same thing as general payroll ledger - it includes summary information with details about each of your employees' salaries/wages.

Where can I find an employee payroll ledger template?

You can use either one of our templates above to create your own payroll ledger.