What are Retained Earnings?

Learn more about retained earnings and how to calculate it, along with frequently asked questions and a free balance sheet template.

Updated on February 15th, 2022

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

Retained earnings are the profits (net income) that a business has earned at a certain point in time, less any dividends paid out to shareholders.

A business typically generates positive or negative earnings (profits or losses). If a company has generated more profits, it will pay out dividends to its shareholders for investing their money in the company. Any residual profits (retained earnings) are reinvested into the company to foster growth or used to pay off any outstanding debt the company may have.

A negative retained earnings balance is known as an accumulated deficit, meaning the company has made more losses than profits. The retained earnings balance is recorded in the Shareholders' Equity section of the company's balance sheet.

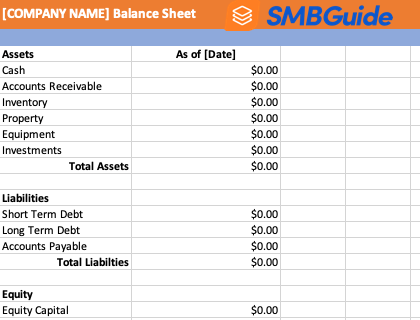

Download Balance Sheet Template:

Download our free balance sheet template in Excel format.

How to Prepare a Statement of Retained Earnings:

The retained earnings statement shows how a company's retained earnings have changed over a financial period. The formula to calculate retained earnings is:

Beginning retained earnings + Profits/losses - Dividends = Ending retained earnings

Accounting Software

FreshBooks Accounting Software

Simplify your accounting tasks with Freshbooks accounting.

No credit card required.

Cancel anytime.

1. Headings.

The heading of the statement is comprised of three lines.

- Company Name.

- Statement of Retained Earnings.

- Preparation Date e.g., "Financial Year Ended 2018."

2. Retained Earnings Balance from the Previous Year.

The first entry on the statement should state the balance carried over from the previous year (beginning retained earnings).

- Retained Earnings for the Year Ended 2018: $50,000

3. Add Net Income.

The second entry on the retained earnings statement is the net income, taken from the balance sheet.

- Retained Earnings for the Year Ended 2018: $50,000

- Plus: Net Income for 2018: $20,000

- Total: $70,000

4. Subtract Dividends Paid out to Shareholders.

Dividends are subtracted from the retained earnings plus the company's net income.

- Retained Earnings for the Year Ended 2018: $50,000

- Plus: Net Income for 2018: $20,000

- Total: $70,000

- Minus: Dividends $10,000

5. Prepare Ending Retained Earnings.

The last entry on the statement is the final amount after dividends have been deducted.

- Retained Earnings for the Year Ended 2018: $50,000

- Plus: Net Income for 2018: $20,000

- Total: $70,000

- Minus: Dividends $10,000

- Ending retained earnings: $60,000

FAQs:

What are retained earnings made up of?

Retained earnings consist of the surplus profits left after paying out dividends to shareholders at the end of an accounting period or financial year.

Are retained earnings a current asset?

No. Retained earnings are not considered a current asset because residual funds left after paying dividends to shareholders are typically used to acquire additional assets or to pay off debt.

Why are retained earnings equity?

Equity is a company's total assets minus its total liabilities. Therefore, retained earnings are considered equity as they can be used to invest in the company.

How do you calculate retained earnings?

Retained earnings are calculated using the formula: Beginning retained earnings + Profits/losses - Dividends = Ending retained earnings.

What are retained earnings on a balance sheet?

At the end of a financial period, retained earnings are reported on a company's balance sheet under the Shareholders' Equity section to show how much funds have been retained by the company.

What is the difference between owner's equity and retained earnings?

Owner's equity is the funds that a business owner has contributed to their own business. Retained earnings are the profits that a company has retained over a period of time.

What is the purpose of retained earnings?

Retained earnings are often reinvested by the company, into the company, to pay off debts, buy new equipment, or be used in research and development.

What are the three components of retained earnings?

A statement of retained earnings balance sheet is usually divided into assets, liabilities, and owner's equity.

What are negative retained earnings?

Retained earnings are calculated using the formula: Beginning retained earnings + Profits/losses - Dividends = Ending retained earnings. When a company records a loss that exceeds the amount of profit previously recorded as beginning retained earnings, then the company has negative retained earnings.