What is Equity?

Get a clear definition of equity and find out what it has to do with your business. Includes frequently asked questions and a free download.

Updated on October 4th, 2021

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

Equity is a shareholder's stake in a company. In other words, if a company were to be liquidated, the value of all shares that were held by shareholders would be returned to them. Businesses sell equity in order to access cash and continue to grow.

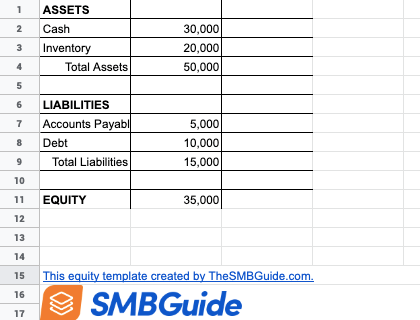

Equity Template - Free Download

Use this simple Excel template to calculate your company's equity.

How to Calculate Shareholder Equity:

Shareholder Equity = Total Assets - Total Liabilities

This formula gives you the total value of all shareholder equity in a company and can be calculated using the information on your balance sheet.

For example...

Company ABC has $800,000 in assets and $150,000 in liabilities.

Using the formula, we find that $800,000 - $150,000 = $650,000.

Thus, equity in the company is worth $650,000.

The Significance of Equity:

Knowing what the equity in your company is worth or has the potential to be worth is important if you want to attract investors who are willing to buy shares. Typically, when someone purchases equity they hope to make a profit when they sell.

If your business has negative equity, it means that your liabilities outweigh your assets. While this may happen during phases of growth and development, prolonged negative equity could lead to bankruptcy.

"Equity" is a general term, but there are several common types of equity that can be made available to shareholders, so you need to understand the differences.

- Common stock: A traditional share that represents ownership and entitles the shareholder to voting rights and dividends.

- Preferred stock: Gives the shareholder a fixed dividend with a payment that is prioritized over common stock.

- Retained earnings: Profits earned to date, minus any dividends that have already been paid out.

- Treasury stock: Company shares that the company has reacquired from shareholders.

Book Value vs. Market Value:

Book Value.

In accounting, the book value is always used to determine the equity in a business. The book value of equity is simply Asset - Liabilities.

Market Value.

The market value is the latest share price that is listed for a publicly traded company. Unlike the book value, the market value is speculative and is affected by factors like demand, what analysts believe the shares will be worth in the future, etc.

To find the market value, you can multiply the latest share price by the number of shares that have been issued.

FAQs:

What exactly is equity?

Equity is the difference between a company's assets and its liabilities, which accurately represents the company's value to shareholders.

What are some examples of equity?

The most common type of equity is common stock. For example, an investor buys 10% equity in XYZ Inc. for $10,000. The shareholder is then entitled to voting rights and dividends because he or she owns part of the business.

What is equity in a business?

Essentially, equity is ownership. There are various types of equity that can be sold. Owning equity means that you own a piece of the business's real value after all debts have been paid.

Is equity real money?

Equity represents real value in a company, but it is only real money if you as a shareholder decide to sell your equity. In other words, it always has value but it can only be spent when you "cash it in." Investors put up money to buy equity, and the value of the equity that they buy is determined by finding the difference between assets and liabilities.

How is equity used?

In a business, equity is used to secure more financing, and to invest in new employees, equipment, etc. Business owners can also choose to hold onto all of their equity if they do not want to leverage it for business growth.

What is the difference between capital and equity?

Capital represents assets that an owner has invested in a business. Equity, on the other hand, is a measure of an owner's share of the business assets.

Is equity an asset?

No. Assets are owned by the business, while equity is a portion of the business that is owned by an owner or shareholder. Assets are used to assess the value of equity, but they are not the same thing.

How do you calculate equity?

You can calculate equity by using the "Shareholder Equity = Total Assets - Total Liabilities" formula.