CAC Payback

Learn more about CAC Payback with a detailed explanation that includes examples and frequently asked questions.

Updated on June 10th, 2022

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

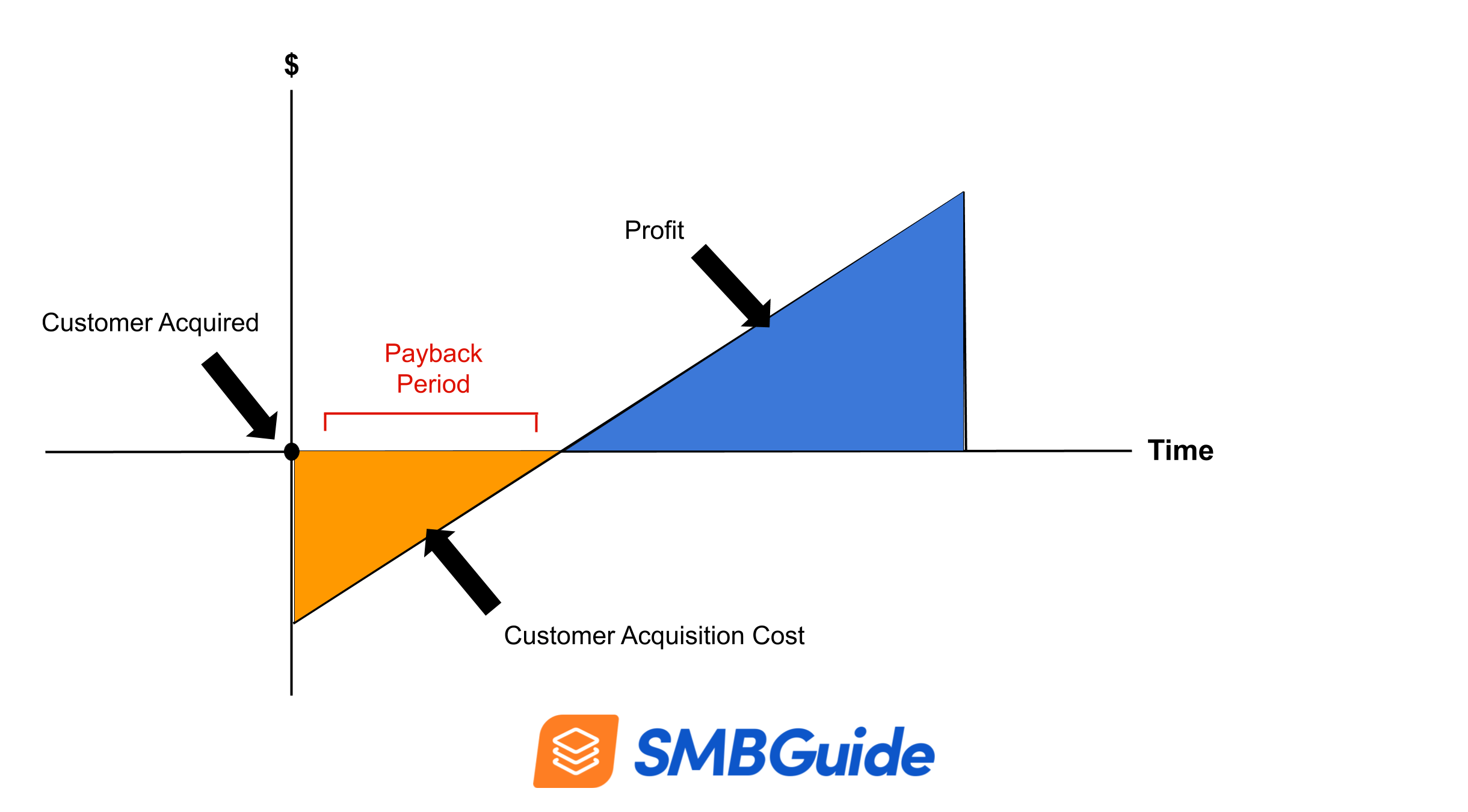

CAC Payback, or the CAC Payback Period, is a metric that measures how long it takes for a business to earn back their initial customer acquisition cost. CAC Payback makes it easy to see how long it takes for a customer that you paid to acquire to become a source of profit. CAC Payback is measured in months.

CAC Payback is usually used by SaaS companies to evaluate the profitability of their marketing efforts when acquiring new subscribers.

How to Calculate CAC Payback:

In order to calculate CAC Payback, you need to know your customer acquisition cost, and the total revenue that a single customer brings in in one year. With these numbers in mind, the formula looks like this:

CAC Payback Period = Customer Acquisition Cost / Annual Revenue from Customer

Let's look at an example:

You operate a SaaS business that charges users a $75 monthly fee. This means that a single subscriber earns you $900 per year in revenue ($75 x 12 months = $900 /yr.).

Assume that your Customer Acquisition Cost is $500 per customer.

Now, using the formula, we can find the CAC Payback Period.

CAC Payback Period = Customer Acquisition Cost / Annual Revenue from Customer

CAC Payback Period = $500 / $900

CAC Payback Period = 0.55

Therefore, your CAC Payback Period is 0.55 years or approximately 6 months.

How to Speed Up CAC Payback:

Long CAC Payback Periods can put a difficult financial strain on your business. You need the money that you've invested in earning new customers to start generating revenue for your business as quickly as possible.

There are several things that you can do to shorten your CAC Payback Period and reach profitability sooner.

- Price your goods/services with the CAC in mind. Prices that are too low will prolong your payback period.

- Develop marketing campaigns that target the largest possible audience. The more customers that you acquire, the lower your CAC will be, meaning that you can pay it off faster.

- Give discounts for annual subscriptions. This will lower your revenue slightly, but it will encourage customers to remain loyal to your business, ensuring that your customer acquisition costs are always met.

FAQs:

What is a good LTV CAC?

A healthy lifetime value to customer acquisition cost ratio is 3 to 1, meaning that the value of each customer should be three times what it cost you to obtain them.

Why is the payback period important?

Much like the break-even point, the CAC Payback Period helps you to determine how quickly the money you spent on marketing will yield a return for your business.

What is the formula for payback period?

CAC Payback Period = Customer Acquisition Cost / Annual Revenue from Customer.