Debt-To-Equity Ratio: What it is and How to Calculate it

Find out what a debt-to-equity ratio is, why it is important to a business, and how to calculate it.

Updated on September 13th, 2023

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

The debt-to-equity ratio is a financial ratio most often used by bankers and investors to tell how well a company uses debt to finance its operations. It is an important calculation for gauging business health and how attractive your company is to banks and investors.

How to Calculate Debt-To-Equity Ratio:

To calculate your company's debt-to-equity ratio you'll need your company's total liabilities and shareholders' equity.

- Debt/Total Liabilities: Money owed to others.

- Shareholders' Equity: Assets minus liabilities.

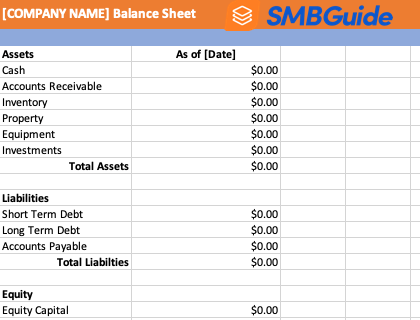

You'll find this information on your company's balance sheet.

Balance Sheet Template

Download our free Balance Sheet template spreadsheet.

Debt-To-Equity Ratio Formula:

D/E = Total Liabillities/Shareholders' Equity

Example:

Your company owes a total of $350,000 in bank loan repayments, investor payments, etc. Your company has $320,000 in Shareholders' Equity.

D/E = Total Liabilities/Shareholders' Equity

D/E = 350,000/320,000

D/E = 1.09

Your company has a debt-to-equity ratio of 1.09.

Interpreting Debt-To-Equity Ratios:

Ratio | Meaning |

|---|---|

0 | Company does not finance growth through debt at all. |

0.5 | Twice as much equity as debt. Investors own two-thirds of the company's assets. |

1 | Creditors and investors own equal parts of company assets. |

1.5 | For every dollar in equity, the company owes $1.50 to creditors. |

2 | Twice as much debt as equity. Creditors own two thirds of company assets. |

A debt-to-equity ratio that is too high suggests the company may be relying too much on lending to fund operations. This makes investing in the company riskier, as the company is primarily funded by debt which must be repaid.

However, a debt-to-equity ratio that is too low suggests the company is paying for most of its operations with equity, which is an inefficient way to grow a business.

A ratio of between 1 and 1.5 is considered ideal. Anything higher than 2, for most industries, is too high.

Debt-To-Equity Ratio Averages by Industry:

Industry | Average Ratio |

|---|---|

Manufacturing | ≥ 2 |

Tech | ≤ 0.5 |

Service | ≥ 1 |

Energy | ≤ 1 |

Healthcare | ≤ 1 |

Transportation | ≤ 1 |

Retail | ≥ 1 |

Utilities | ≤ 1.5 |

Financial | ≤ 2 |

FAQs:

What is a good debt-to-equity ratio?

A debt-to-equity ratio of between 1 and 1.5 is good for most businesses, but some industries are capital intensive and businesses in these industries traditionally take on more debt.

Is it better to have a higher or lower debt-to-equity ratio?

Generally, the lower the ratio, the better. Anything between 0.5 and 1.5 in most industries is considered good.

What does a debt-to-equity ratio of 1.5 mean?

A debt-to-equity ratio of 1.5 shows that the company uses slightly more debt than equity to stimulate growth. For every dollar in shareholders' equity, the company owes $1.50 to creditors.

What does a debt-to-equity ratio of 1 mean?

A debt-to-equity ratio of 1 means a company has a perfect balance between its debt and equity, and that creditors and investors own equal parts of the company's assets.

What does a debt-to-equity ratio of 2 mean?

A debt-to-equity ratio of 2 means a company relies twice as much on debt to drive growth than it does on equity, and that creditors, therefore, own two-thirds of the company's assets.

What if a debt-to-equity ratio is less than 1?

Investors and banks tend to prefer companies with debt-to-equity ratios of less than 1 because there is less risk in investing in companies that have fewer financial responsibilities to creditors.

Why is the debt-to-equity ratio important?

The debt-to-equity ratio is important because it gauges how healthy the relationship in the business is between debt and equity, and expresses the capacity of a business to raise financing for growth.

Is a negative debt-to-equity ratio good?

No. A negative debt-to-equity ratio can mean one of two things: the interest on a loan used to make an investment is greater than the returns from that investment, or the company has a negative net value.

How do you interpret debt-to-equity ratio?

The debt-to-equity ratio is expressed as a number. The higher the number, the greater the reliance a company has on debt to fund growth. The lower the number, the greater the reliance on equity.

What is a long-term debt-to-equity ratio?

A long-term debt-to-equity ratio is a ratio that expresses the relationship between a company's long-term debts and its equity. It is the same formula for calculating the debt-to-equity ratio, but instead of dividing the company's total liabilities by its shareholders' equity, one divides the company's long-term debt by its equity.

Is accounts payable included in debt-to-equity ratio?

Yes. Accounts payable form part of a company's current liabilities.

What does a debt-to-equity ratio of 0.5 mean?

A debt-to-equity ratio of 0.5 means a company relies twice as much on equity to drive growth than it does on debt, and that investors, therefore, own two-thirds of the company's assets.

What is the formula for debt-to-equity ratio?

D/E = Total Liability/Shareholders' Equity.