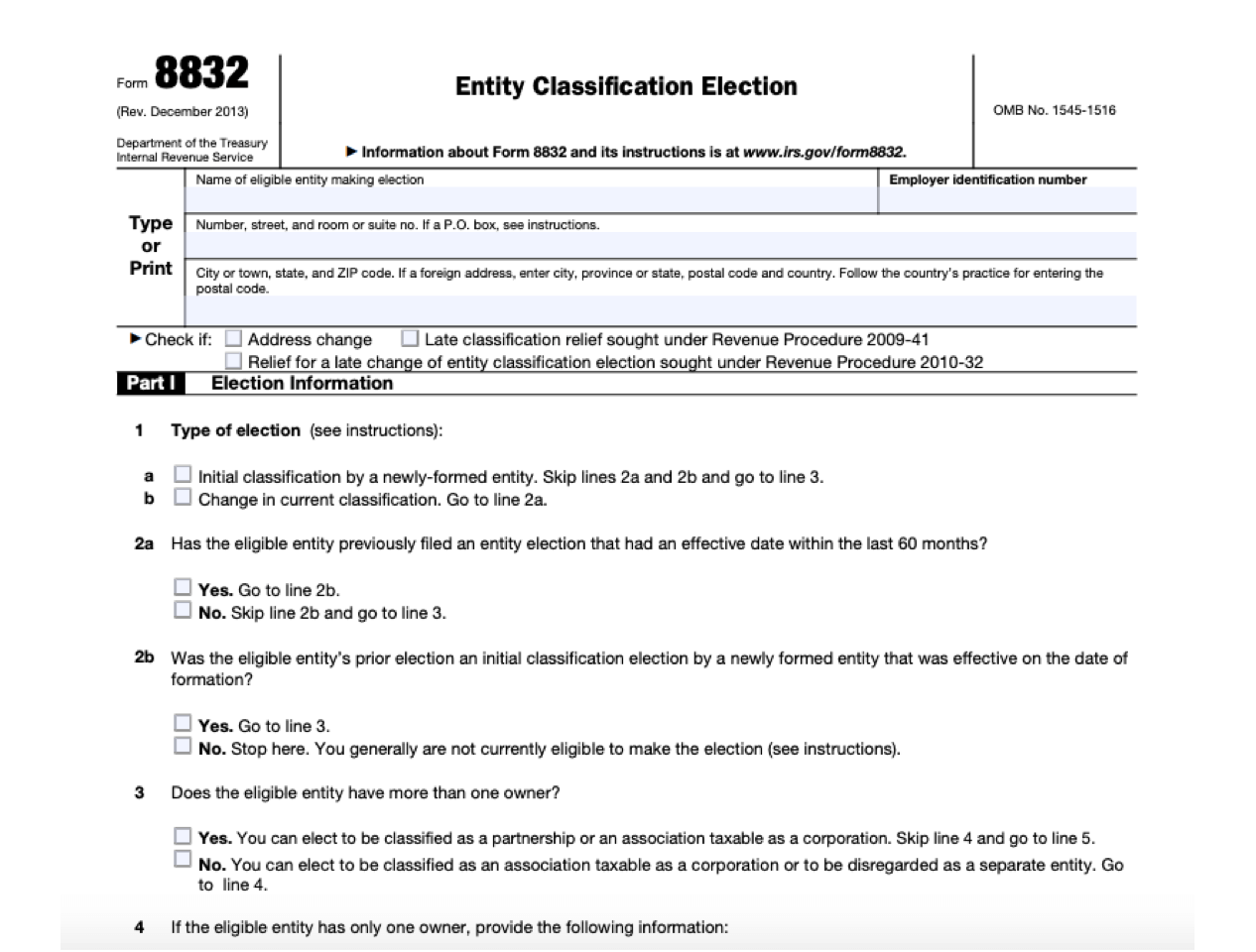

Form 8832

Read about IRS Form 8832 for entity classification. Includes step-by-step filing instructions and frequently asked questions.

Updated on October 21st, 2021

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

Form 8832 is the IRS entity classification election form that business owners can use to designate the classification of their business entity (Corporation, Partnership, etc.). This form can be used to notify the IRS that your business is changing from its default tax classification.

Below you will find step-by-step instructions for filing Form 8832, as well as some frequently asked questions.

Form 8832 Instructions:

Identify your business entity.

At the top of the form, you will find a section where you must type or print the name of your business, your employer identification number, and your address. You must also check one of the boxes if you are filing for:

- An address change.

- Late classification relief.

- Relief for a late change of entity.

If none of these options are applicable, then do not check a box.

Answer questions in Part 1 (Election information).

Part 1 is in the form of a questionnaire that asks about the current classification of your business and your history in regards to filing for a new classification. In the section, the name(s) of the owner(s) and any parent corporation(s) must be identified.

The name and contact information of a contact person must also be recorded in case the IRS needs to contact you regarding Form 8832.

Sign the consent statement.

The consent section must be signed by an authorized officer or officers of the business. The signees must also add the date and their official title. These signatures represent your agreement that all of the information on the form accurately reflects the reality of your business entity.

Explain and sign late election relief portion, if necessary.

If you need the new status of your entity to be applicable to previous financial activity, you can apply for late relief. Late relief, when it is granted, allows you to classify your business entity differently for past taxable income. You may not be approved for late relief, but the form requires that you provide an explanation as to why you did not file as intended previously. The request for late relief must also be signed and dated.

Submit Form 8832.

Form 8832 should be submitted with a copy of your company's federal tax return. Submitting these documents together will ensure that the IRS has all of the applicable information to either grant or deny your request to change your business' status.

How to Fill out Form 8832:

- Enter your business contact information.

- Provide details about the type of business entity you are electing.

- Complete the questionnaire on the form.

- Explain why you are applying for late election relief.

FAQs:

Who must sign Form 8832?

Each member of the electing business who is an owner at the time of the election, or any manager, officer, or member of the business who is legally authorized to make the election, must sign Form 8832.

How do I file Form 8832?

You can file the completed Form 8832 with the IRS Service Center for your state. You should also send a copy of the form with your next business tax return.

What is an 8832 form?

Form 8832 is used to notify the IRS of a change in the classification of your business entity. It is sometimes called Form 8832 Late Election Relief.

Should I file Form 8832?

You should file Form 8832 if you want your small business or LLC to be taxed as a different kind of company, such as a corporation or S Corp.

What is the difference between Form 8832 and 2553?

Form 8832 is used by partnerships and LLCs if they want to change their default tax classification and be taxed as different kinds of companies, such as a corporation.

Form 2553 is for traditional corporations to elect S corporation status, specifically.

Does a single member LLC need to file Form 8832?

If you choose not to file Form 8832, the IRS will treat your single-member LLC as a disregarded entity and tax you as a sole proprietorship.

Who can qualify for late relief?

The IRS has a resource page explaining the rules for late election relief.

How long does it take to find out if my application on Form 8832 was accepted?

The IRS will notify your business of acceptance or non-acceptance within 60 days of the form being filed. Carefully fill out the form according to the instructions for 8832 to make sure that there are no delays.

Where can I find Form 8832?

You can download a print-friendly version of form 8832 in PDF format from the IRS.

Where are the official IRS form 8832 instructions?

There are detailed Form 8832 filing instructions on page 6 of the form. The official 8832 form instructions should clear up any confusion that you may have when filling out the form. The IRS 8832 instructions are very detailed, so they should address any questions that come up while you are completing the paperwork.

How does Form 8832 late election work?

If your application for late election is accepted and you qualify for late election relief 8832, your business can be reclassified and you can file your taxes as a different type of business entity.